This is Part 2 of this Timeless Trading Basics series. If you haven’t yet read Part 1 then head over to part 1 here! You can also sign up to our newsletter to avoid missing out and like/follow/join us on social media!

Effective Risk Management for Basic Trading Success

The term risk management is one of the timeless trading basics which comes up in a few areas in trading and here are the two key areas: –

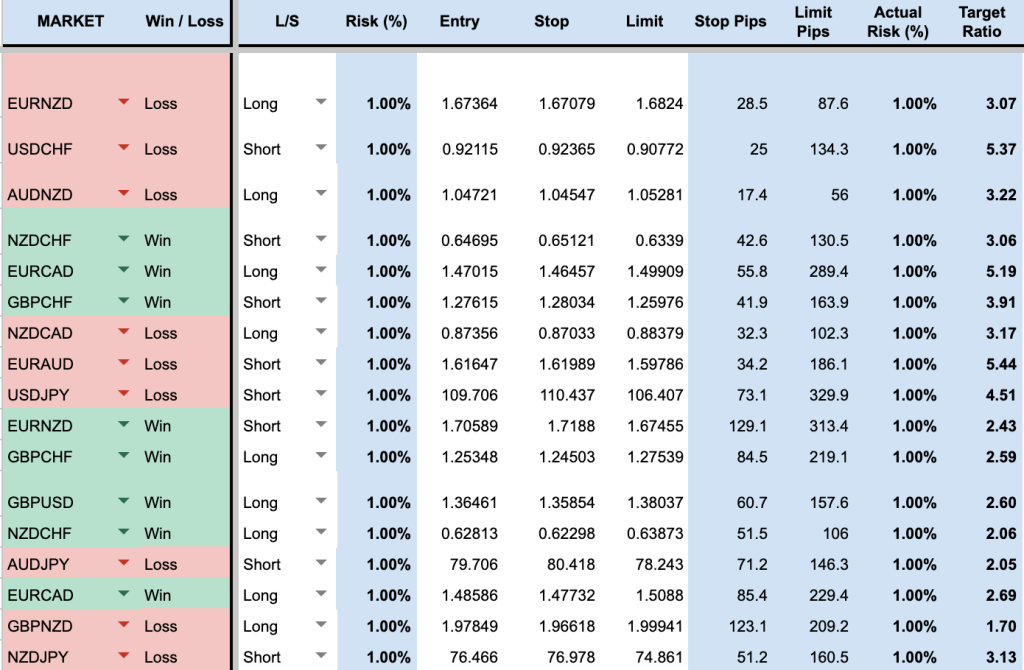

- The possible outcomes of a trade. If you set your Stop Loss (the auto closure of your trade if it goes against you) to 10 points and your Target Profit (the auto closure of your trade if it goes in your favour) to 20 points then you have a 1:2 risk. This means that long term, you need your win ratio to be over 33.33% to be successful.

- How much of your capital you want to risk on each trade. It is highly recommended by most that using no more than 1% per trade is sensible. Personally I would go even smaller than this but we can discuss this in a different article. As an example, if you have an account with $10,000 and you risk 1% per trade, you are risking $100 each time you place a trade.

Effective risk management is essential for becoming a profitable trader. You need to make sure that your losses are smaller than you wins. There is a saying “Cut your losses short and let your winners run”. Position sizing is fundamental to becoming a successful trader. If you have a risk, reward ratio of 1:1 then you need to win more than 50% of the time, which is difficult. Generally, a risk-reward ratio of 1:3 or higher is considered a good practice, meaning the potential reward is at least three times greater than the potential risk. It also means a win rate needs only to be above 25%. The bottom line is that if you want to be successful then you need to minimise losses and preserve your capital.

The Power of Journaling in Trading Improvement

Journalling my trades was something that I personally found very difficult initially. I used to be lazy and impatient when I was learning. I always thought “what’s the point?”, the trade has gone now and the brokers have a complete log if I need to go back. Well if your mind works like mine and you skip things that involve too much effort then please don’t and let me explain what the point is.

It is a fact that when you track things, they improve. This is applied to everything – losing weight, quitting smoking, cutting down alcohol, making money, exercising etc etc. Trading is no different.

When you have the results to your trading you can then simply see what is working and what isn’t. You can then adjust, improve the results and therefore become more successful. It really is as simple as that. In Elder’s book he stresses the importance to include information like emotion at the time, the strategy used, the reasoning for the trade and for closing (if manually closed). This all helps to give better decisions when in the same situation in the future. Some tips for journalling might be to use or create a template or your own, make sure it includes both numerical and descriptive data. We could provide a template of our own as an example if you wish, please reach out with the contact form or on social media if you believe this would be helpful. Once you have your journalling template and start building data then you need to also regularly review and analyse the trades. If something is no longer working then change it now you have this data.

Embracing the 80/20 Rule in Trading Education

I believe that trading is over 80% about the psychology and less than 20% about the technical abilities. This means that when learning you should apply 80% of your learning on yourself and some of the aspect in this article.

Although the 80/20 rule can apply to many aspects in life, it is particularly applicable in trading. The saying “80% is psychology and only 20% is technical skills” emphasises the importance of emotional and mental discipline over the technical ability. This highlights that, while having a good understanding of technical analysis, risk management and strategy development is crucial, the ability to maintain emotional control and mental discipline is the much more key to long-term success in trading. This balance can be achieved by cultivating a growth mindset, managing expectations and developing strong emotional resilience. Apart from the mentioned book above, here are a couple of decent books to help achieve this balance – “Trading in the Zone” by Mark Douglas and “Mindset: The New Psychology of Success” by Carol Dweck. Additionally, you can benefit from attending workshops and courses on trading psychology, as well as utilising mindfulness practices such as meditation – this will strengthen your emotional resilience and mental focus. To summarise, while technical skills are important, I believe that psychology is the absolute foundation for successful trading.

Actionable Takeaways of the Timeless Trading Basics Series

- Consider three key resources: Dr. Alexander Elder’s “The New Trading for a Living”, Mark Douglas’ “Trading in the Zone” and Carol Dweck’s “Mindset: The New Psychology of Success”.

- Focus on self awareness and managing your emotions – introduce things like meditation and visualisation, checklists can also be very useful to remove some emotions.

- Build discipline – work on basic disciplines by regularly choosing to do something against your natural wants.

- Try to be persistent and complete a few small courses, avoid the “shiny coin syndrome”.

- Learn about probabilities. It is essential to understand the probabilities and expectations in trading.

- Start journalling demo trades to get the hang of it. If it becomes standard from the start then it makes it easier for the future.

If you’ve enjoyed this and would like to discover more of our tips & resources then please head over here! You can also sign up to our newsletter to avoid missing out and like/follow/join us on social media!